Accountability and Transparency in Government

Citizen's Guide to Finances: Pension Liability

Pension Plan

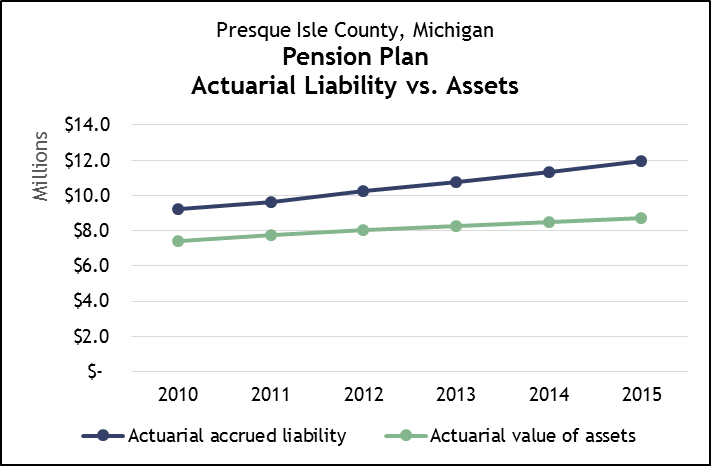

Actuarial

Assets v.

Liabilities

2010-2015

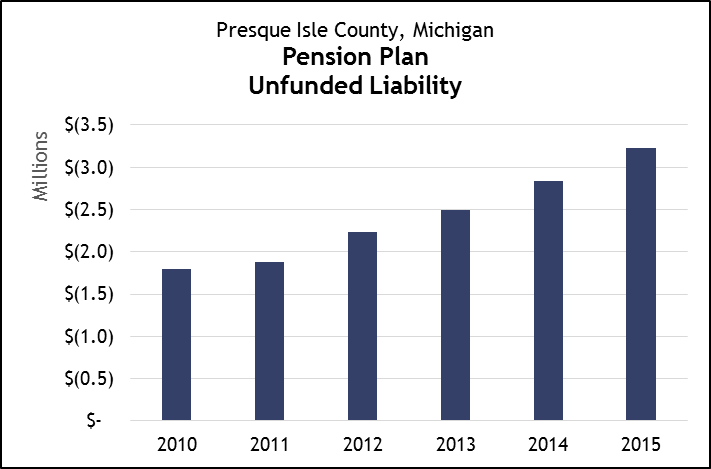

Unfunded

Liability

2010-2015

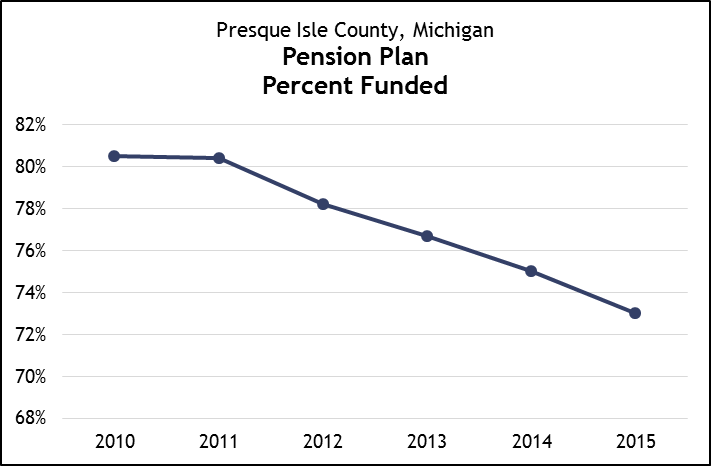

Percentage

Funded

2010-2015

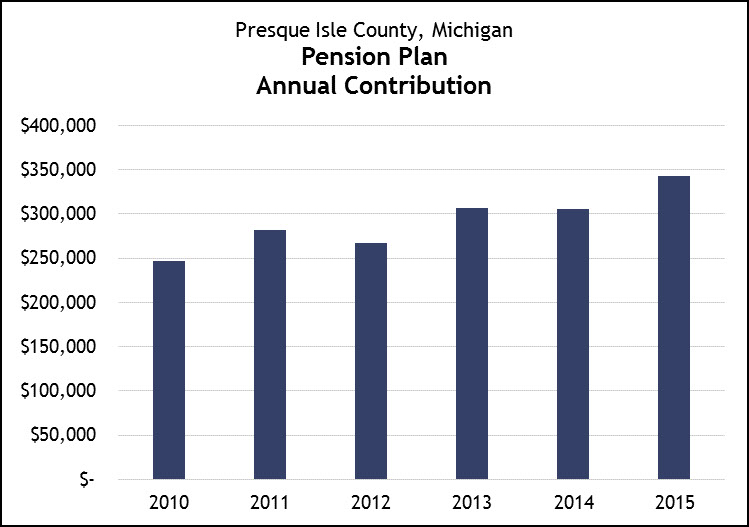

Annual

Contribution

2010-2015

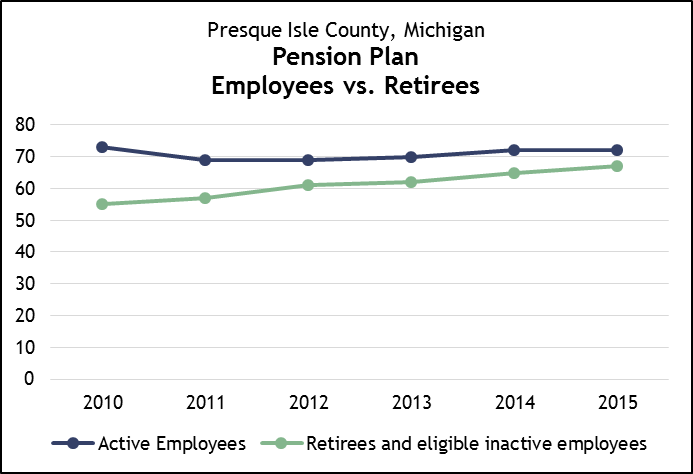

Employee to

Retiree

Comparison

2010-2015

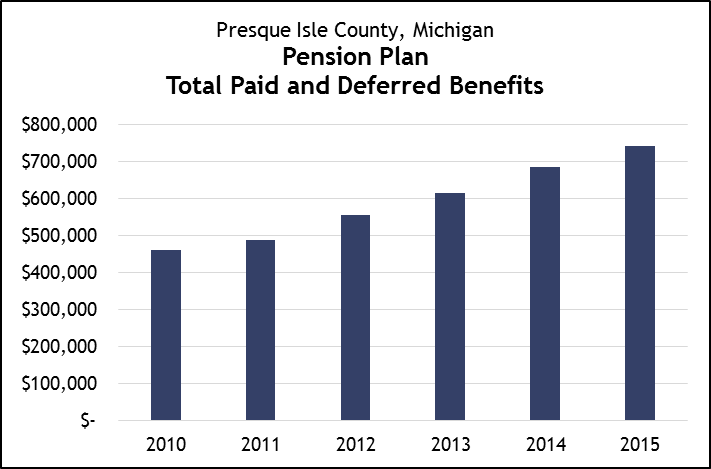

Benefit

Payouts

2010-2015

| Pension Plan Actuarial Valuations as of Decemeber 31, |

2014 | 2015 | % Change | Trend |

|---|---|---|---|---|

Value of assets |

$ 8,506,943 |

$ 8,711,218 |

2.4% |

|

Accrued liability |

11,347,158 |

11,935,524 |

5.2% |

|

Overfunded (underfunded) |

$ (2,840,215) |

$ (3,224,306) |

13.5% |

|

Percent funded |

75.0% |

73.0% |

- 2.7% |

|

Unfunded liability as a percent of General Fund revenues |

56.88% |

61.2% |

7.6% |

|

Annual county contribution |

$ 305,065 |

$ 343,230 |

12.5% |

|

Active employees |

72 |

72 |

- 0 - |

|

Retirees and eligible inactive employees |

65 |

67 |

3.1% |

|

Ratio of employees to retirees (inc. eligible non-actives) |

1.11 |

1.07 |

- 3.6% |

|

Active employee salary |

$ 2,302,053 |

$ 2,319,824 |

0.8% |

|

Benefits paid (inc. deferred benefits) |

$ 684,987 |

$ 742,102 |

8.3% |

|

Prepared by MGT of America Consulting, LLC

Great Lakes Region

2343 Delta Road

Bay City MI, 48706